22nd December 2022

Scottish Grocers’ Federation publish Annual Review 2022.

SGF has published our yearly report, looking back at the work carried out on behalf of members throughout 2022.

The Review highlights the outstanding work of our colleagues in SGF’s Healthy Living Programme and the Go Local programme, as well as a summary outlining SGF’s headline activities on some of the challenges facing the convivence retail sector.

Please click here for the full report or go to SGF Annual Review 2022. Additionally, at the back of the report you can find a list of the key SGF events planned for 2023.

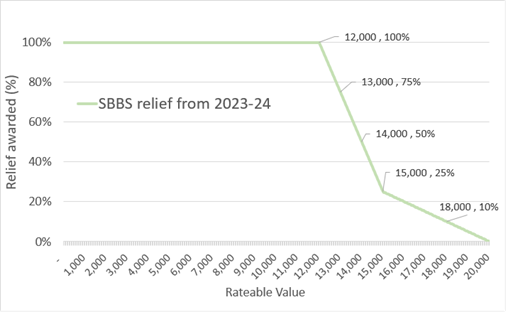

Reductions to Small Business Bonus Scheme in Scottish Budget

The Scottish Budget 2023-24, delivered by the Deputy First Minister on 15th Dec 2022, sets out plans to reduce the amount of Business Rates relief some small business will receive through the Small Business Bonus Scheme. Read the SGF Press Release here: Reduced Threshold for Rates Relief Could Punish Struggling Businesses

As set out in the chart below, 100% SBBS relief will continue to be available for properties with a rateable value up to £12,000. However, relief will taper from 100% to 25% for properties with RVs between £12,001 and £15,000. Previously the threshold for 100% relief was set at £15,000 RV.

Non-Domestic Rates will see a freeze to the Basic Property Rate.

Scottish Government announce spending plans for 2023/24.

Alongside a range of measures introduced in the Scottish Budget, the Deputy First Minister set out plans to increase Income Tax to support spending in 2023/24.

There will be no changes to the rate of Income Tax paid by lower earners, however, rates will rise for people earning more than £43,663. The higher rate will move from 41p to 42p and the top rate from 46p to 47p.

These measures were announced alongside a ranges of spending commitments for the coming year. For the all the details, read the Deputy First Minister’s statement here and find the full Scottish Budget 2023-24 here.

UK Alcohol Duty Rates, freeze extended

The UK Government has announced that the freeze to UK alcohol duty rates has been extended by six months from 1 February to 1 August 2023. Read the full statement here.

King Charles III banknotes unveiled

The Bank of England has unveiled the design of our King Charles III banknotes. The King’s portrait will appear on all four of our polymer banknotes (£5, £10, £20 and £50). The rest of the design on the banknotes will remain the same, including the security features that your staff check during transactions. The notes are due to enter circulation by mid-2024.

Visit the Bank of England guidance page for helpful information on what the changes mean for your business: Guidance on New Banknotes

Scottish Grocers’ Federation Press Cuttings (week of 28th Nov)

Please find a range of press articles with comments and contributions from SGF, available to view here.

Prohibition on Pavement Parking to come into force Dec 2023

Regulations set out in the Transport (Scotland) Act 2019 are due to come into force in December 2023. The new rules will make it illegal for most vehicles to park on any part of the pavement, in Scotland.

The exceptions for vehicles delivering, loading, or unloading goods is as follows: “pavement parking is permitted for as long as is necessary to carry out the delivery, collection, loading or unloading up to a maximum of 20 minutes. Provided that they have maintained a clear footway area for pedestrians to pass of no less than 1.5m”.

Scottish Government guidance was provided to councils this week setting out the criterial for setting an exception for an area/street. Assessments are to be carried out on a case-by-case basis; however, exemptions can only be considered if pavement parking would continue to allow a width of at least 1.5m on the footpath and/or parking on the carriageway would impede emergency vehicles.

ScotGov Consultation on Restricting Alcohol Advertising & Promotion

It is possible to respond to the consultation via Citizen Space using the following link: Alcohol Advertising & Promotion portal. Contact the Alcohol Harm Prevention team at: alcoholmarketing@gov.scot. Deadline: Thursday 9th March 2023

For more details about the proposed measures and consultation, please click here see a two-page SGF Consultation Summery.

Protect Duty Announcement (Martyn’s Law)

Retail and hospitality premises with a capacity of over 100 people may soon be required to carry out additional preparations to help prevent a terrorist attack. There isn’t yet a date for the proposals to come into force, however the UK Govt have started the process of developing the legislation and bringing it before Parliament.

For those with a ‘duty to increase their preparedness for and protection from a terrorist attack’, the level of action these need to take will depend on the size:

A standard tier will drive good preparedness outcomes. Duty holders will be required to undertake simple yet effective activities to improve protective security and preparedness. This will apply to qualifying locations with a maximum capacity of over 100. This could include larger retail stores, bars, or restaurants.

An enhanced tier will see additional requirements placed on high-capacity locations in recognition of the potential catastrophic consequences of a successful attack. This will apply to locations with a capacity of over 800 people at any time. This could include live music venues, theatres, and department stores.

For more information go to: Fact Sheet or view the UK Govt Press Release here.

Scottish Assessors 2023 Valuation Roll

The Draft 2023 Valuation Roll is available at the Scottish Assessors Portal. Scottish Assessors – Scottish Assessors Association website (saa.gov.uk)

The following non-domestic rates instruments were signed on 8 December and laid in Parliament on 12 December. These are:

The Valuation Timetable (Scotland) Order 2022

The Valuation Roll and Valuation Notice (Scotland) Order 2022

The Valuation (Proposals Procedure) (Scotland) Regulations 2022

Circularity Scotland Update – DRS registration opens this month

Please click here to view the latest Stakeholder Update from Circularity Scotland Limited, for December 2022.

NOTE: Producer Registration with Circularity Scotland will begin from 12th December.

If you have any queries, please email enquiries@circularityscotland.com

Deposit Return Scheme Retailers Toolkit

Please click here to view an industry guidebook on DRS produced by Circularity Scotland.

Office of National Statistics – UK Labour Market

The ONS have published the latest set of national statistics on the Labour Market in the regions of the UK.

Health and Safety Executive Weekly Digest ebulletin

To view the full bulletin, go to: HSE Weekly Update

This week's edition features:

advice and resources on preventing work-related stress

guidance on helping workers stay safe and warm

Resource Management Association Scotland (RMAS)

Please click the links to view the weekly briefing note and the monthly Market Trends Report from RMAS.